Delving into the realm of auto policy quotes in Germany opens up a world of intricacies and nuances that shape the insurance landscape. As we navigate through the details, a captivating journey awaits, shedding light on the unique aspects of auto insurance policies in the German market.

The following paragraphs will provide a comprehensive exploration of the key elements surrounding auto policy quotes in Germany, offering valuable insights and guidance for those seeking clarity in this complex domain.

Overview of Auto Policy Quotes in Germany

Understanding auto policy quotes in Germany is essential for anyone looking to insure their vehicle in the German insurance market. It is important to grasp the intricacies of these quotes to make informed decisions about coverage and premiums.

Key Differences in Auto Insurance Policies

- Compulsory Third-Party Liability: In Germany, all vehicles must have liability insurance to cover damages to third parties. This is a legal requirement that differs from some other countries where additional coverage may be optional.

- Comprehensive Coverage: German auto insurance policies often include comprehensive coverage for damages to your own vehicle, which may not be standard in other countries.

- Personal Injury Protection: German policies typically provide robust personal injury protection, ensuring that medical expenses are covered in the event of an accident.

Main Components of an Auto Policy Quote

- Premium: The cost you pay for insurance coverage, which can vary based on factors such as your driving history, age, and type of vehicle.

- Deductible: The amount you are responsible for paying out of pocket before the insurance coverage kicks in.

- Coverage Limits: The maximum amount the insurance company will pay for damages or claims, which can vary depending on the type of coverage.

- Add-Ons: Additional coverage options you can choose to enhance your policy, such as roadside assistance or rental car reimbursement.

Factors Influencing Auto Policy Quotes

Age, driving history, type of vehicle, location, and urban/rural settings all play a significant role in determining auto policy quotes in Germany. Insurance companies assess these factors carefully to calculate the risk involved and set appropriate premiums.

Age, Driving History, and Type of Vehicle

The age of the driver, their driving history, and the type of vehicle they own are crucial factors that influence auto policy quotes in Germany. Younger drivers with less experience and a history of accidents or traffic violations are often considered higher risk and may face higher premiums.

Additionally, expensive or high-performance vehicles can lead to increased insurance costs due to the potential for costly repairs or replacements.

Role of Location and Urban/Rural Settings

The location where a vehicle is primarily driven also affects auto insurance costs in Germany. Urban areas with higher population densities and more traffic congestion are associated with a greater risk of accidents and theft, resulting in higher premiums. On the other hand, rural settings with lower crime rates and less traffic may lead to lower insurance costs.

Assessment of Risk Factors by Insurance Companies

Insurance companies in Germany utilize various risk assessment methods to determine policy quotes. They consider factors such as the driver's age, driving record, vehicle type, location, and even credit history to evaluate the likelihood of claims. By analyzing these variables, insurers can tailor premiums to reflect the specific risk profile of each policyholder accurately.

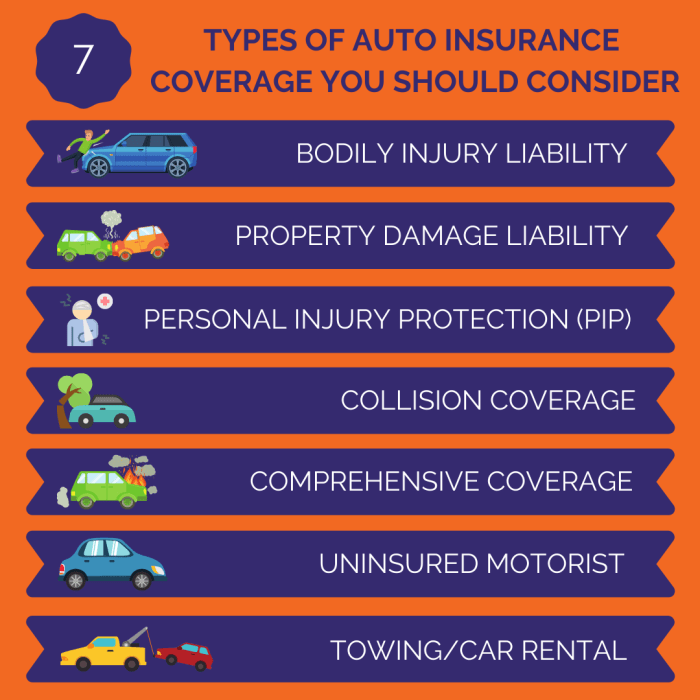

Understanding Coverage Options

When it comes to auto insurance policies in Germany, there are various coverage options available to suit different needs and preferences. Understanding these options can help you make an informed decision when choosing the right policy for your vehicle.

Types of Coverage Options

- Comprehensive Coverage: This type of coverage provides protection for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Third-Party Liability: This is mandatory in Germany and covers damages caused to third parties, including their vehicle or property, in the event of an accident where you are at fault.

- Partial Coverage: Also known as "Teilkasko," this coverage option includes protection against specific risks like theft, fire, glass breakage, and damages caused by wild animals.

- Additional Coverage Options: You can also opt for extras like roadside assistance, legal protection, or coverage for personal belongings inside the vehicle. These additional options can impact your policy quotes.

Legal Requirements and Regulations

In Germany, auto insurance is mandatory for all vehicles. The legal requirements dictate that every vehicle on the road must have at least third-party liability insurance coverage.

Minimum Coverage Limits

- All vehicles must have a minimum coverage of €7.5 million for personal injury and €1.12 million for property damage.

- These limits ensure that individuals involved in accidents are adequately compensated for any damages or injuries.

Impact on Policy Quotes

- Adherence to these legal requirements directly influences the cost of policy quotes. Insurers consider the mandatory coverage limits when calculating premiums.

- Vehicles with higher coverage limits may have higher premiums, reflecting the increased financial protection provided by the policy.

Recent Changes in Insurance Laws

- In recent years, there have been discussions about potentially increasing the minimum coverage limits to better protect accident victims.

- Changes in insurance laws to raise the coverage limits could lead to higher policy quotes for vehicle owners.

Tips for Comparing Policy Quotes

When it comes to comparing auto policy quotes in Germany, it's essential to have a clear understanding of what to look for in order to make an informed decision. By considering key aspects and evaluating different factors, you can identify the best value for money and choose the right auto insurance policy for your needs.

Comparing Coverage Options

- Review the types of coverage offered by each insurance provider, including liability, comprehensive, and collision coverage.

- Compare the coverage limits, deductibles, and additional benefits included in each policy to determine which one aligns best with your needs.

- Consider any exclusions or limitations in the coverage that may affect your decision.

Examining Premium Costs

- Compare the premium costs for each policy, taking into account any discounts or special offers provided by the insurance provider.

- Consider the payment options available and any fees or charges associated with the policy.

- Look for any hidden costs or factors that may impact the overall affordability of the policy.

Assessing Customer Reviews and Reputation

- Research customer reviews and ratings for each insurance provider to gauge their reputation and customer service quality.

- Consider the insurer's claim settlement process and responsiveness to customer inquiries or concerns.

- Choose a provider with a solid reputation and positive feedback from policyholders to ensure a reliable and satisfactory experience.

Common Misconceptions about Auto Policy Quotes

When it comes to obtaining auto policy quotes in Germany, there are several common misconceptions that people may have. These myths can often lead to misunderstandings about factors influencing policy costs and coverage options. Let's debunk some of these myths and clarify the implications on policy quotes.

Myth 1: Red Cars Are More Expensive to Insure

Contrary to popular belief, the color of your car does not impact your insurance premium. While some people think that red cars are more expensive to insure, insurers actually consider factors like make, model, age, and driving history when calculating premiums.

Myth 2: Comprehensive Coverage Is Always the Best Option

While comprehensive coverage offers extensive protection, it may not always be the most cost-effective option for everyone. Depending on your individual needs and budget, opting for a more basic policy with additional add-ons may be a better choice.

Myth 3: Older Cars Automatically Have Lower Premiums

Although older cars may have lower market values, their insurance premiums are determined by other factors such as safety features, repair costs, and the driver's risk profile. In some cases, insuring an older car can actually be more expensive than a newer one.

Myth 4: The Minimum Legal Requirement Coverage Is Sufficient

While meeting the minimum legal requirements for coverage is mandatory, it may not always provide adequate protection in case of accidents or unforeseen circumstances. It's important to carefully assess your coverage needs and consider additional options to ensure you are adequately protected.

Ending Remarks

In conclusion, the intricate web of factors influencing auto policy quotes in Germany unveils a tapestry of information essential for making informed decisions in the realm of insurance. With this guide at hand, readers are equipped with the knowledge to navigate the intricacies of auto policy quotes with confidence and understanding.

FAQ Corner

What factors influence auto policy quotes in Germany?

Factors such as age, driving history, type of vehicle, and location play a significant role in determining auto insurance costs in Germany.

What are the main components of an auto policy quote in Germany?

The main components typically include coverage options, legal requirements, and additional services like roadside assistance or legal protection.

How can one effectively compare policy quotes from different providers in Germany?

Strategies for comparing policy quotes involve looking at coverage options, cost, and value for money offered by each provider, ensuring a comprehensive evaluation process.