Starting off with Discount Car Insurance Quotes: How to Save Big in New Zealand, this opening paragraph aims to engage readers with insightful information on finding affordable car insurance and comparing quotes effectively.

As we delve deeper into the topic, we'll explore key factors affecting car insurance premiums and provide practical tips for saving on insurance costs in New Zealand.

Introduction to Discount Car Insurance Quotes in New Zealand

When it comes to owning a car in New Zealand, having affordable car insurance is essential. Not only does it protect you financially in case of accidents or damages, but it is also a legal requirement. However, finding the right car insurance that fits your budget can be a daunting task.

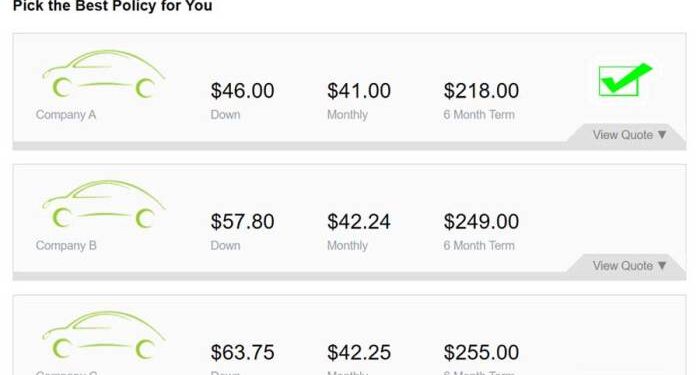

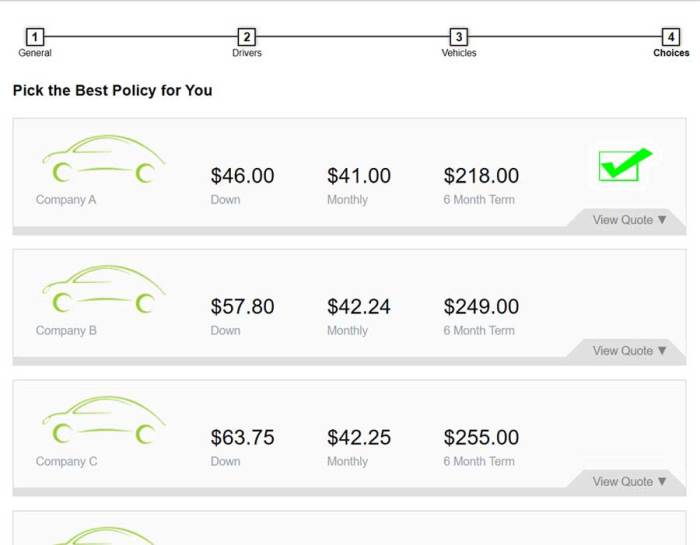

One way to save money on car insurance is by comparing quotes from different providers. By doing so, you can find the best coverage at the most competitive rates. This process allows you to see what each insurance company offers in terms of benefits, discounts, and premiums.

The Average Cost of Car Insurance in New Zealand

According to recent statistics, the average annual cost of car insurance in New Zealand can vary significantly depending on factors such as age, driving experience, location, and the type of vehicle you drive. On average, car owners can expect to pay around $600 to $1,200 per year for comprehensive car insurance coverage.

Factors Affecting Car Insurance Premiums

When it comes to car insurance premiums, there are several key factors that can influence the cost of coverage. Understanding these factors can help you make informed decisions to save on your car insurance in New Zealand.

Type of Vehicle Impact on Insurance Costs

The type of vehicle you drive plays a significant role in determining your car insurance premiums. Insurers consider factors such as the make and model of your car, its age, safety features, and the likelihood of theft or vandalism when calculating your insurance rates.

For example, sports cars and luxury vehicles typically have higher insurance premiums due to their higher repair costs and increased risk of accidents.

Personal Factors and Driving History

Your personal factors, such as age, driving experience, and claims history, also impact your car insurance premiums. Younger drivers and those with limited driving experience often face higher insurance rates due to their higher risk of accidents. Additionally, drivers with a history of accidents or traffic violations may see an increase in their premiums as they are considered higher-risk drivers.

Tips for Saving on Car Insurance

When it comes to car insurance in New Zealand, there are several ways to save money on your premiums. By being proactive and strategic, you can lower your insurance costs while still maintaining the coverage you need.

Bundle Policies for Potential Discounts

One effective way to save on car insurance is to bundle your policies. This means purchasing multiple insurance products from the same provider, such as combining your car insurance with home or life insurance. Insurance companies often offer discounts for bundling policies, so be sure to inquire about potential savings when exploring your options.

Negotiate with Insurance Providers for Better Rates

Don't be afraid to negotiate with insurance providers to secure better rates. If you have a clean driving record, a good credit score, or have completed a defensive driving course, use these factors to your advantage when discussing your premiums.

Additionally, consider increasing your deductible or opting for a usage-based insurance program to potentially lower your costs.

Comparison of Different Insurance Providers

When looking for car insurance in New Zealand, it's essential to compare different insurance providers to find the best coverage options at competitive rates. Each insurance company offers various features and benefits, so it's crucial to evaluate them based on your specific needs and preferences.

Popular Car Insurance Companies in New Zealand

- AA Insurance: Known for its comprehensive coverage options and excellent customer service.

- State Insurance: Offers a range of policies tailored to different driver profiles and vehicle types.

- AMI Insurance: Focuses on providing affordable insurance solutions with flexible payment plans.

- Youi Insurance: Stands out for its personalized approach to car insurance and innovative policy features.

Coverage Options Offered by Each Provider

- AA Insurance: Offers comprehensive, third party, fire and theft, and third party only coverage options.

- State Insurance: Provides options for full coverage, third party, and specialized policies for classic cars.

- AMI Insurance: Offers policies for comprehensive coverage, third party, and third party, fire and theft.

- Youi Insurance: Provides tailored coverage options based on individual driver profiles and preferences.

Customer Satisfaction Ratings and Reviews

- AA Insurance: Highly rated for customer satisfaction and claims processing efficiency.

- State Insurance: Known for its responsive customer service and personalized insurance solutions.

- AMI Insurance: Receives positive reviews for affordability and ease of policy management.

- Youi Insurance: Praised for its innovative approach to car insurance and customer-centric policies.

Understanding Discounts and Special Offers

When it comes to car insurance in New Zealand, understanding the discounts and special offers available can help you save significantly on your premiums. Let's explore some common ways you can reduce your insurance costs and take advantage of special deals.

Common Discounts for Car Insurance Policies

- Multi-policy discount: Many insurance providers offer discounts if you bundle your car insurance with other policies, such as home or contents insurance.

- No claims bonus: If you have not made any claims during a certain period, you may be eligible for a no claims bonus, which can lead to a reduction in your premium.

- Age-related discounts: Young drivers under 25 or senior drivers over 65 may be eligible for age-related discounts to help offset the higher risk associated with these age groups.

Special Offers for Saving on Premiums

- Introductory discounts: Some insurers offer special discounts for new customers, which can provide significant savings in the first year of coverage.

- Promo code discounts: Keep an eye out for promo codes or special offers that can be applied when purchasing a new policy or renewing an existing one.

- Referral discounts: Referring friends or family members to your insurance provider may make you eligible for referral discounts, reducing your premiums.

Loyalty Programs and Rewards

- Loyalty discounts: Insurance companies often reward long-term customers with loyalty discounts, reducing premiums for policyholders who have been with the company for a certain number of years.

- Rewards programs: Some insurers offer rewards programs where you can earn points for safe driving habits or for renewing your policy, which can be redeemed for discounts or other benefits.

- Bonus features: Loyalty programs may also include bonus features such as free roadside assistance or increased coverage limits for loyal customers.

Importance of Reading the Fine Print

When it comes to car insurance, the devil is in the details. It's crucial to thoroughly read and understand the fine print of your policy to avoid any surprises or misunderstandings down the road.

Common Exclusions and Limitations

Car insurance policies often come with exclusions and limitations that may not be immediately apparent. It's essential to be aware of these to avoid any issues when making a claim.

- Some common exclusions include:

- Acts of nature such as floods or earthquakes.

- Intentional damage or illegal activities.

- Regular wear and tear of the vehicle.

- Limitations may include:

- Maximum reimbursement amounts for specific types of claims.

- Restrictions on coverage for certain drivers or vehicles.

Filing Claims and Accuracy

When it comes time to file a claim, accuracy is key. Providing incorrect or incomplete information could result in delays or even denial of your claim. Understanding the process and requirements can help ensure a smooth claims experience.

Final Summary

In conclusion, Discount Car Insurance Quotes: How to Save Big in New Zealand sheds light on the importance of reading the fine print, understanding discounts, and choosing the right insurance provider for your needs.

FAQ Guide

What factors influence car insurance rates in New Zealand?

Factors such as type of vehicle, age, and driving history play a significant role in determining car insurance premiums.

How can drivers save on car insurance costs in New Zealand?

Drivers can save by bundling policies, comparing quotes, and negotiating with insurance providers for better rates.

What are common discounts available for car insurance policies?

Common discounts include multi-policy discounts, safe driver discounts, and discounts for low mileage.